Railroad retirement calculator

In general its 0007 times the average monthly earnings. The Railroad Retirement Board RRB is an independent agency in the Executive Branch of the Federal Government.

Ooh This One Gives Me A Bit Of Creative Spark I Don T Exactly Know What It Is But I Think I Could Modelleisenbahn Anordnung Modellbahn Eisenbahn Modellbau

It was started in the 1930s to nationalize railroad.

/GettyImages-172591496-0f1d54d8ee6f417f995098368dc2abe3.jpg)

. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. And then one final thing I threw in there unlike tier one there is no delayed retirement credits. Railroad Retirement Board William O.

Your railroad earnings before 1973 are not shown on your Statement but we do use them in calculating your credits. Under Social Security the. Railroad Retirement Board William O.

It provides retirement survivor unemployment and sickness benefits to individuals who have spent a substantial portion of. The Railroad Retirement Program is a federal program that extends retirement benefits to railroad employees. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free.

Railroad Retirement Board William O. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. As a career railroader who is expecting a significant Railroad Retirement Annuity benefit your goal for Tier 1 and Tier 2 Railroad Retirement Annuity should be to cover your.

Tier 2 monthly amount will be something like 0007 times the total amount you earned divided by 60 months multiplied by your 5 years. TaxSlayer incorrectly includes RR retirement benefits in the retirement exclusion. Railroad Retirement Board William O.

They dont include supplemental security income SSI. The formula for the gross tier II amount is 710 of 1 of the employees average monthly railroad earnings up to the tier II taxable maximum earnings base in the 60 months. Tier one you can get those delayed retirement.

Our goal for this process is to demonstrate in plain. Boarding for Railroad Retirement A simple 3-step process showing how you can improve retirement success lower your tax bill. But RR retirement benefits are not taxable in any state thus has its own.

The Railroad Retirement program was established in the 1930s. Assuming employees have similar work histories and receive maximum monthly benefits a person receiving Railroad Retirement would collect 2700 a month. So thats the early retirement.

10 rows Income Worksheet. Social security benefits that may be taxable to you include monthly retirement survivor and disability benefits. Your actual benefit amount may differ from an estimate for any or all of the following if you.

The program was established in the 1930s and in addition to. Your Social Security Statement yearly earnings from 1973 to present. Using the AIME calculate.

Have other circumstances as defined by the Railroad Retirement Act. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. 90 of the first AIME bend point plus 32 of the amount in excess of the first bend point but less than or equal to the second bend point plus 15 of the amount.

When Can I Retire Early Retirement Calculator Fire Calculator Engaging Data Retirement Calculator When Can I Retire Early Retirement

Retirement Calculator Word Banner In 2022 Calculator Words Retirement Calculator Creative Typography

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

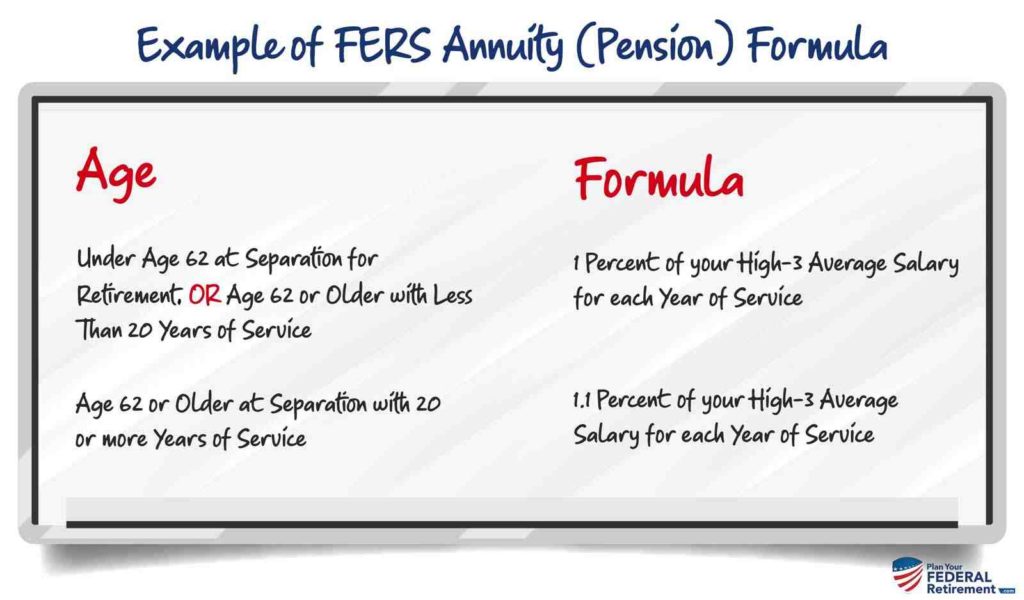

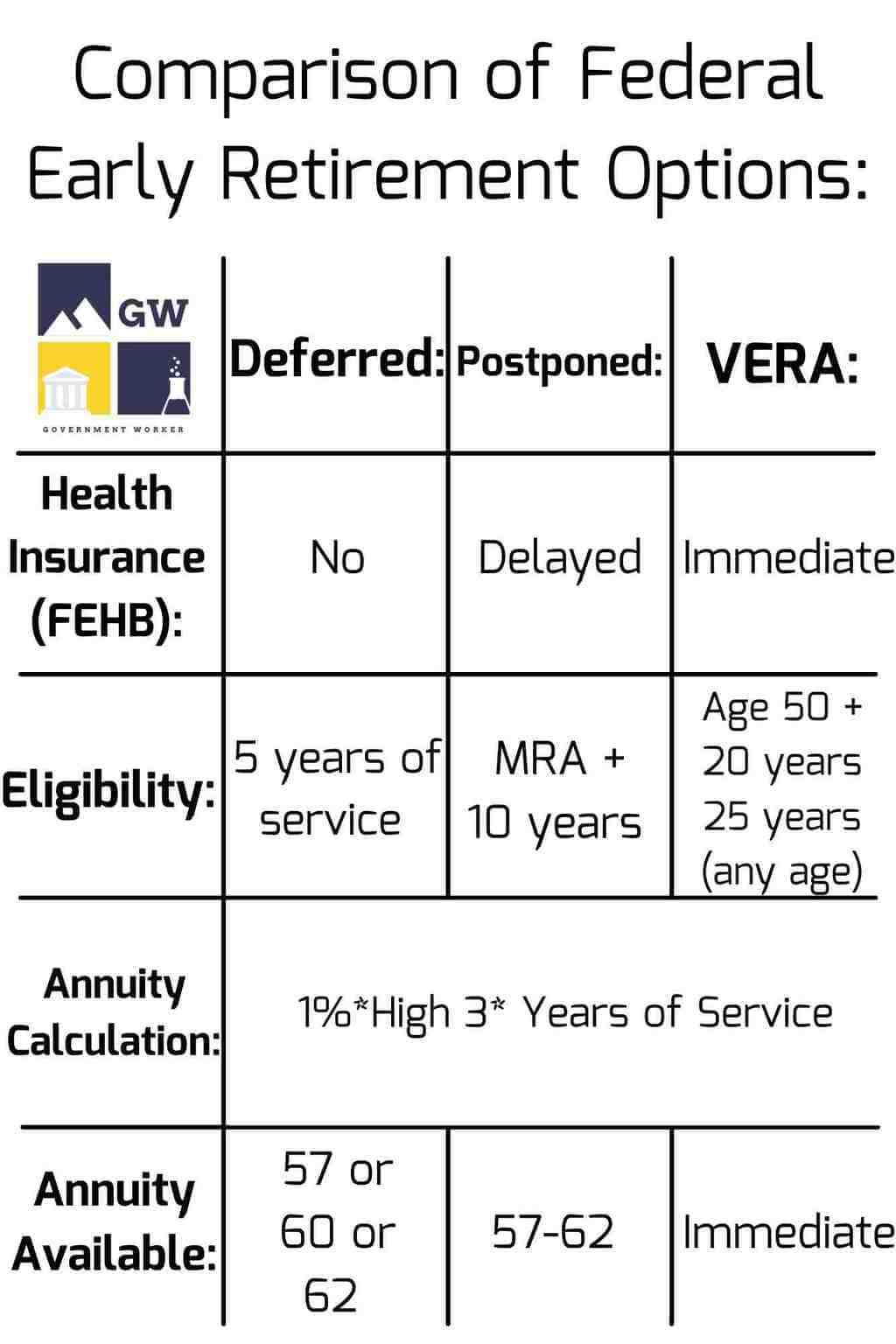

Federal Pension Calculator Government Deal Funding

What Is Bookkeeping And How To Do Bookkeeping In 2022 Forbes Advisor

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

Narvre How To Calculate For Your Retirement

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Railroad Retirement Calculated On Highest Earning Months Or Years Of Service Youtube

Timing Calculator Calculator App Calendar

/GettyImages-172591496-0f1d54d8ee6f417f995098368dc2abe3.jpg)

Primary Insurance Amount Pia Definition

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Wondering What The Cost Of Senior Living Is Use Our Cost Calculator Chart Infographic Senior Living Infographic

Fact Or Fiction Homebuyer Edition How To Find Out Facts Home Buying

Federal Pension Calculator Government Deal Funding

2

Federal Pension Calculator Government Deal Funding